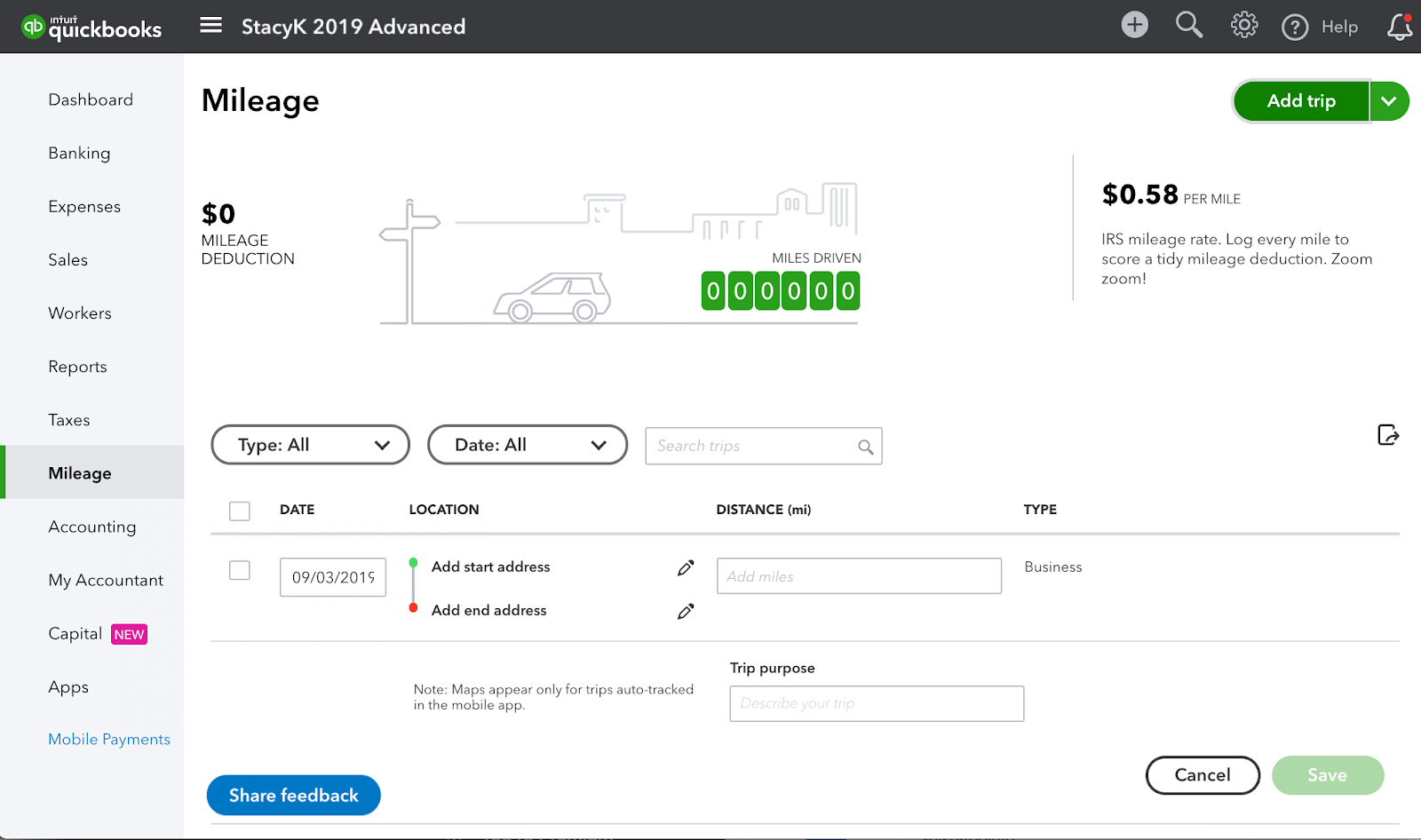

QuickBooks can apply a rule to categorise a recurring route as enterprise or private. Users might want to add the starting and ending locations for their favorite places. To avoid confusion, customers can even name their favourite routes.

We will take a look at each method to trace miles precisely. The Mileage by Buyer Report in QuickBooks On-line enables businesses to discover out mileage related to particular shoppers, enabling exact billing and improved consumer satisfaction. Beta features have very limited availability and are topic to alter. Sure, you’ll have the ability to easily share tax details, like mileage, through the mileage report.

![]()

V. If you should edit the location or distance, select the journey, make your changes, after which select Save. If you forget to trace a trip, you can always add one manually through the web browser. For probably the most accurate journey tracking, additionally turn on Motion & Health or Bodily Exercise permissions. Strictly Needed Cookie ought to be enabled at all times so that we can save your preferences for cookie settings. If you might have a group of sales reps, you need a granular view of their mileage.

Get Detailed Mileage Reviews

Study tips on how to make probably the most of your tax deductions by understanding what you can declare and the way to hold accurate information of everything you want to again up your deductions. If you have to change or manually add a past journey, here’s the means to edit or add journeys manually within the QuickBooks Self-Employed app. Swipe left on the trip’s report to categorize it as business and right to mark it personal. Enter the trip’s objective if it’s a enterprise trip and click on on Save.

The Quality Assurance Process: The Roles And Duties

If there are multiple Time Charges, then click the Add All button to add all of them. Every Time Charge will be added on its own line in the invoice. Another helpful button is at the backside that say Copy Final Timesheet. This can save time if a employee has the same schedule each week. Subsequent, for every day that work was accomplished, you’ll enter the billable hours for Sunday through Saturday in every cell. The whole shall be calculated for you on the finish of the row.

These apps present enhanced options and performance to streamline your mileage tracking, saving you time and effort. We frequently check Timeero mileage tracking alongside different mileage trackers, and it constantly snags a spot in the high echelon by way of accuracy. Some apps are probably to miss shorter enterprise trips, however that isn’t the case with Timeero. Regardless of how long or quick the journey is, Timeero will log mileage, offered the automobile exceeds the bottom quickbooks mileage tracker app pace. Automated mileage tracking stops overreliance on odometer readings and guide mileage logs, negating the impact of human error on your logs.

Deliver Your Miles With You

Make certain to refer to the official QuickBooks Online documentation or contact their assist should you encounter any difficulties through the setup course of. The days of grappling with these issues are lastly over, due to Timeero segmented monitoring. With the characteristic, the sale rep will only have to clock in as quickly as, get on with their buyer visits and clock out at the end of the day.

There are two ways to calculate your corporation mileage deduction — the standard mileage methodology and the precise expense method. You won’t be succesful of take both deductions, so choose the method that greatest fits your work. You can use an expense management app to combine with QBO. Contemplate having a 3rd get together tracker app on your employees to integrate with QBO. Whether Or Not you’re self-employed or a commission-based salaried worker, the advice in this article can help you keep your hard-earned cash by profiting from https://www.quickbooks-payroll.org/ tax time deductions.

![]()

The One Massive Beautiful Invoice Act (OBBBA) introduced or updated quite a few business-related tax provisions. The modifications which may be prone to have a serious impact on employers and payroll management corporations embody new data return and payroll tax reporting guidelines…. Sadly, common mileage trackers require sales reps to clock in and out at every customer’s location to attain the results talked about above. First and foremost, Timeero uses automatic-drive detection to log worker miles. You only must set the bottom speed and ask employees to obtain the Timeero app on Android or iOS gadgets.

- To strive that, go to the New button in the left-side Navigation Pane and select Invoice.

- When cutting costs, think beyond the obvious, corresponding to wages,…

- By classifying trips depending on clients and shoppers, businesses can exactly assign expenses and consider the effectivity of customer-related touring.

- I can help with your mileage tracking concern, Beautiful.

- Setting up mileage rates in QuickBooks On-line takes just a few simple steps and lets you streamline your expense tracking process.

- Besides that, mileage tracking is baked into QuickBooks Time.

Welcome to our information on the method to track mileage in QuickBooks Online. Properly tracking and managing mileage expenses is essential for companies of all sizes. QuickBooks can monitor users’ enterprise mileage routinely if customers give the app permission to entry their places.

If our Timeero vs. QuickBooks mileage tracker results are anything to go by, Timeero may ship better results than the Intuit products. Add that to Timeero’s inexpensive pricing, and you get a time and mileage tracker price attempting for any massive or small enterprise. If you wish to automate mileage monitoring, you’ve in all probability considered the QuickBooks mileage tracker. Nonetheless, you don’t have to make an uninformed buying choice. We took the mileage tracker app for a test drive to see the method it performs. We hope that this article has helped you a big number and supplied you deep insights into the topic of the method to report mileage expenses in QuickBooks On-line.